For workers and retirees in some states, there may be a welcome tax break.

Most Americans hope to retire by age 62, according to a survey by Natixis Investment Managers.

However, most have to wait longer, as the average retirement age for baby boomers is about 68.

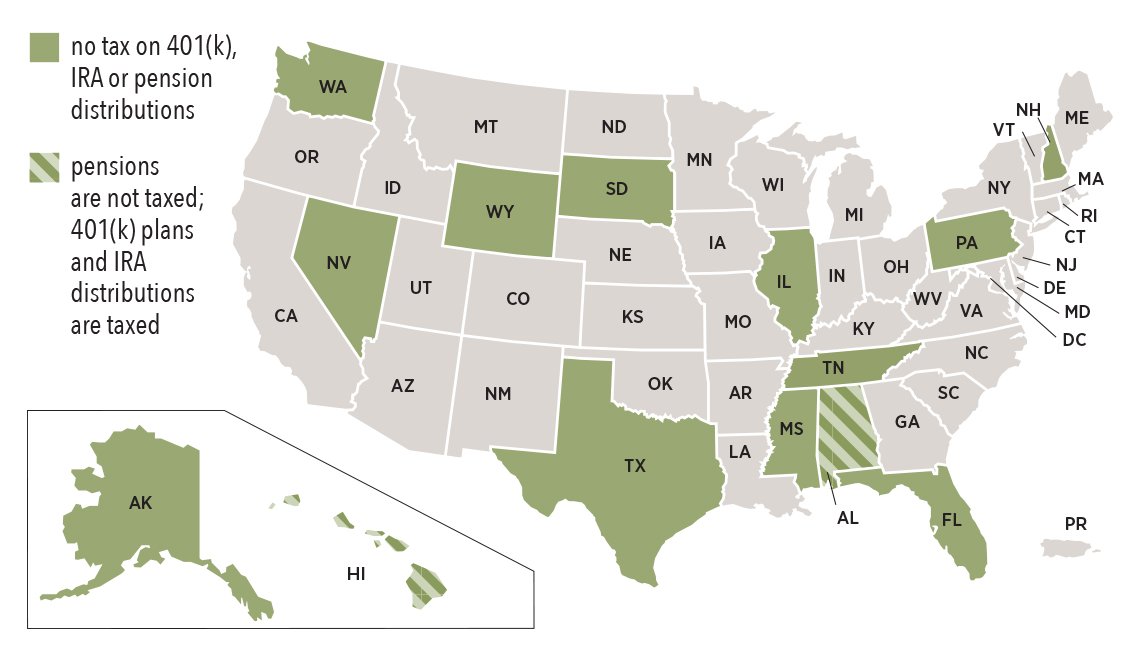

Fortunately, there are twelve states where retiring may stretch your nest egg.

These states do not tax distributions from pensions or defined contribution plans such as 401(k) plans.

Where are retirement withdrawals tax free?

There are nine states that do not have any income tax at all – this includes retirement plan income.

Nine of those states are: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. The remaining three — Illinois, Mississippi and Pennsylvania — don’t tax distributions from 401(k) plans, IRAs or pensions. Alabama and Hawaii don’t tax pensions, but do tax distributions from 401(k) plans and IRAs.

Exceptions for veterans

There are also some exceptions for those who have served in the military.

For example, there are 34 states that do not tax military retirement income.

Military retirement income is earned through a military pension.

Members of the military who serve for 20 years are eligible for this retirement pay.

The way it is taxed varies state by state.

Of the 34 states that do not tax military retirement income – nine of them are the states listed above, that do not have any income taxes at all.

The others include: Arizona, Alabama, Arkansas, Connecticut, Hawaii, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New York, North Carolina, North Dakota, Ohio, Pennsylvania, Utah, West Virginia and Wisconsin.

All other states have some type of partial tax exception for those who have served.

How do retirement accounts withdrawals work?

For both a traditional and Roth IRA, withdrawals can be made at any time and in any amount.

However, with a traditional IRA, you are required to begin taking distributions by April 1 the year after you turn 72.

For a Roth IRA, you are not required to take minimum distributions.

How are retirement accounts usually taxed?

Here, the rules differ for traditional and Roth IRAs.

For a traditional IRA, deductible contributions and earnings that are withdrawn or that get distributed are subject to tax.

With a Roth IRA, qualified distributions and withdrawals are not taxable.

In some cases, part of the withdrawal could be taxable.

If you are under age 59 ½ when you take a withdrawal, a 10% tax may apply unless you qualify for an exception.

State Taxes and Retirement Distributions

Should you be in the midst of a divorce or contemplating divorce, contact the Law Offices of Renee Lazar at 978-844-4095 to schedule a FREE one hour no obligation consultation.